U.S. News

Big Expectations: Bitcoin ‘Halving’ Again In April

By Matt De Vlieger · February 1, 2024

What is Bitcoin Halving?

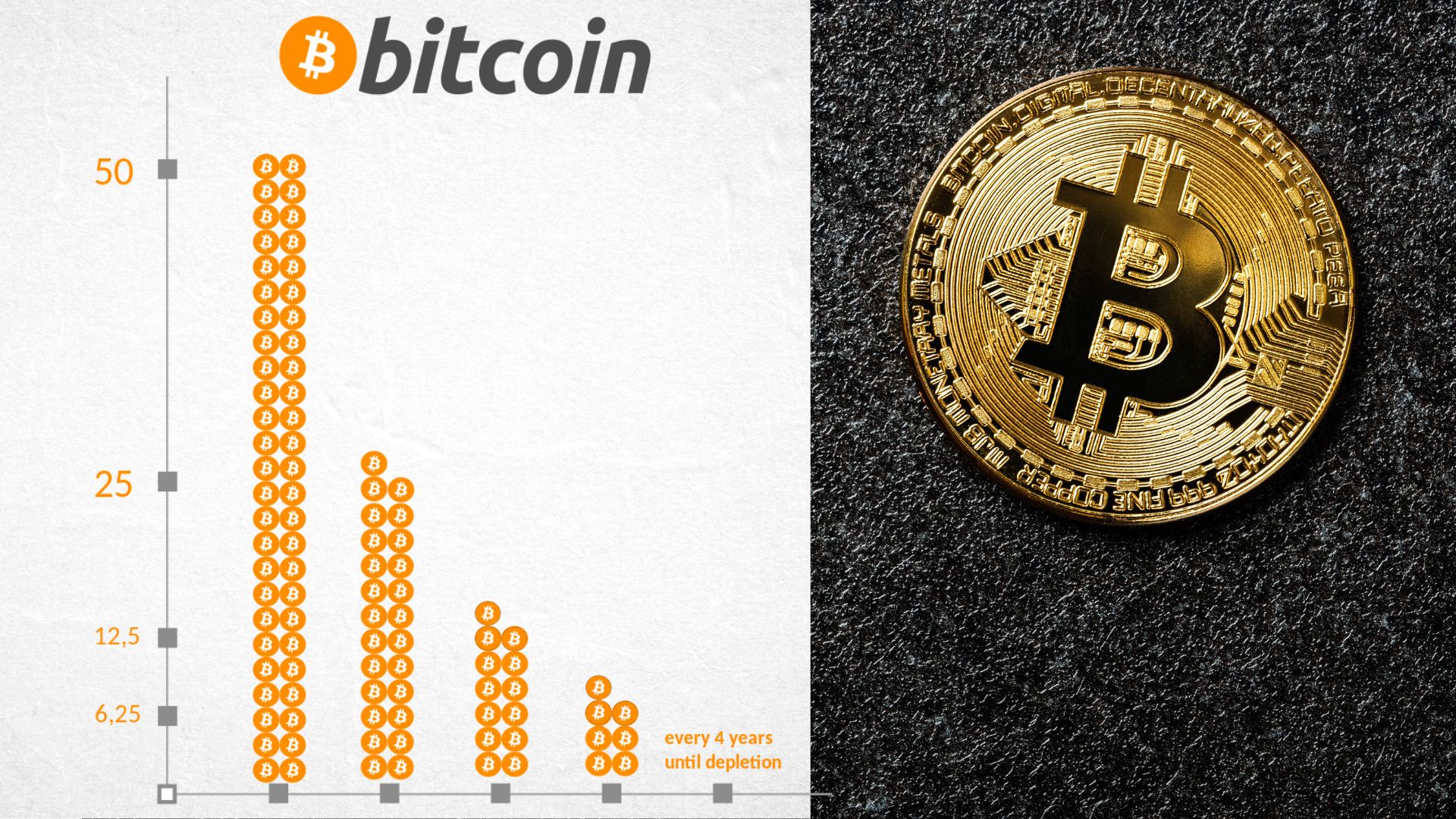

Bitcoin halving occurs approximately every four years, or after every 210,000 blocks are mined on the Bitcoin blockchain. The event marks one of the most anticipated moments for crypto investors.

Control of Supply

The purpose of Bitcoin halving is to control the supply of new bitcoins entering circulation, ensuring a predictable and gradual issuance over time.

First Ever Halving

The first Bitcoin halving occurred in November 2012, reducing the block reward from 50 bitcoins to 25 bitcoins per block.

Community Reception

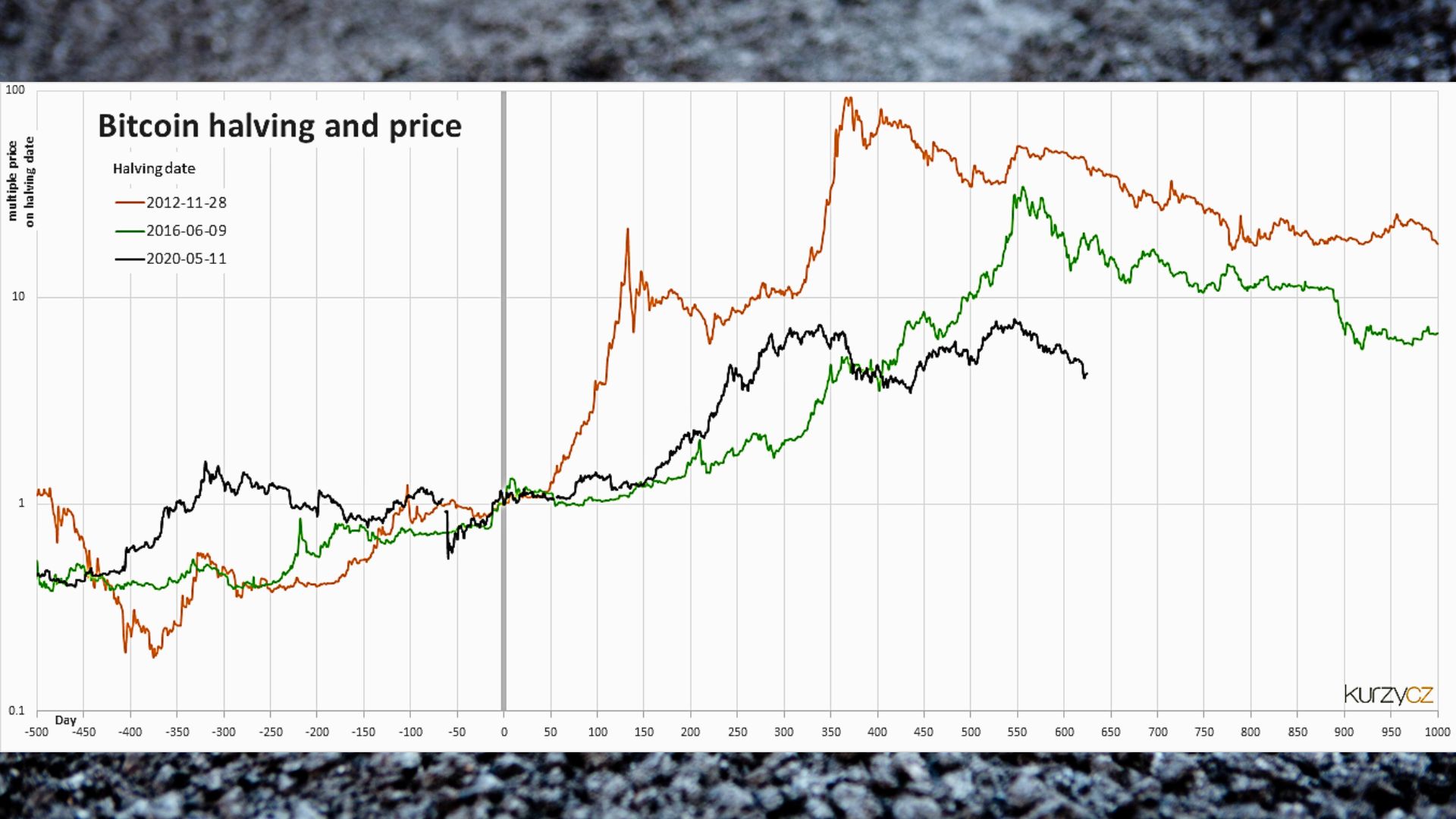

The 2012 Bitcoin halving was preceded by hype and anticipation within the Bitcoin community, leading to post-halving volatility followed by a gradual price appreciation. This event underscored Bitcoin's scarcity, triggered a long-term bullish trend, and solidified Bitcoin's credibility as a decentralized digital currency with deflationary properties, setting the stage for continued growth and adoption.

Second Halving

The second Bitcoin halving took place in July 2016, further reducing the block reward to 12.5 bitcoins per block.

Price Maturity

Unlike the first halving, the second halving saw a more informed market reaction with increased volatility in the short term followed by a sustained period of price appreciation. Additionally, the mining landscape had evolved significantly, with professionalized mining operations and broader recognition of Bitcoin as a legitimate asset class among institutional investors and traditional financial institutions.

April 2024

The upcoming Bitcoin halving is expected to occur in April 2024, cutting the block reward in half again to 6.25 bitcoins per block.

Built-in Feature

Bitcoin halving events are pre-programmed into the Bitcoin protocol and are not influenced by external factors or central authorities.

All the Hype

Historically, Bitcoin halvings have been associated with increased media attention, heightened speculation, and sometimes, short-term price volatility.

Bull Market

Bitcoin halvings are often viewed as bullish events by cryptocurrency enthusiasts and investors, as they highlight Bitcoin's scarcity and its deflationary nature.

Long-term Price

Some analysts believe that Bitcoin halvings play a role in driving long-term price appreciation, as the reduction in new supply gradually diminishes over time.

Market Dynamics

Bitcoin halvings are significant milestones in Bitcoin's monetary policy and are closely watched by the cryptocurrency community for their potential impact on market dynamics and sentiment.